Understanding Stamp Duty and Registration Charges is essential to ensure a smooth and lawful transfer of property ownership. Both these elements are pivotal and make ing re that your property transactions are not only lawful but also transparent and secure.

Property Registration, mandated by the Registration Act of 1908, is a crucial legal procedure that validates and records the sale of a property and ensures the legal transfer of ownership from seller to buyer.

Two financial components of property registration that buyers must understand are the Registration Fees and Stamp Duty charges.

Paying registration charges to officially register the property safeguards the buyer’s ownership rights, whereas stamp duty payments serve as a government’s acknowledgment of the property transaction, ensuring it adheres to legal and fiscal norms.

Together, they restrict the prevalence of fraudulent transactions and black money circulation in the real estate sector, ensuring that the dealings are conducted at fair market values and are recorded in public records, reducing potential legal disputes related to ownership.

Whether you are a first-time home buyer, a seasoned investor, or simply someone looking to enhance your knowledge, this comprehensive guide on the Stamp Duty and Registration Charges in India unravels the complexities of the legal and financial obligations of property transactions and provides a clear understanding of the charges, rates, fees structures in various states and cities, calculation methods, payment methods, and more.

What we have Covered in this Blog:

Stamp Duty is a tax levied on property transactions under the Indian Stamp Act, 1899. The stamp duty payable is typically a percentage of the property value and can vary significantly across different states in India due to the decentralization of fiscal governance.

Paying Stamp Duty legalizes the sale or transfer of the property, making the transaction lawful and valid. It also ensures that the deal is transparent and is conducted at the fair market value, thereby minimizing the scope for fraudulent transactions.

Registration charges refer to the fees associated with officially recording and documenting the transfer of ownership from the seller to the buyer (under the Registration Act, 1908). These charges are typically a percentage of the property’s value and can vary significantly from one state to another in India.

Property registration charges act as legal acknowledgment of the ownership transfer, providing governmental assurance of the legitimacy of the transaction and legally recorded in the public records.

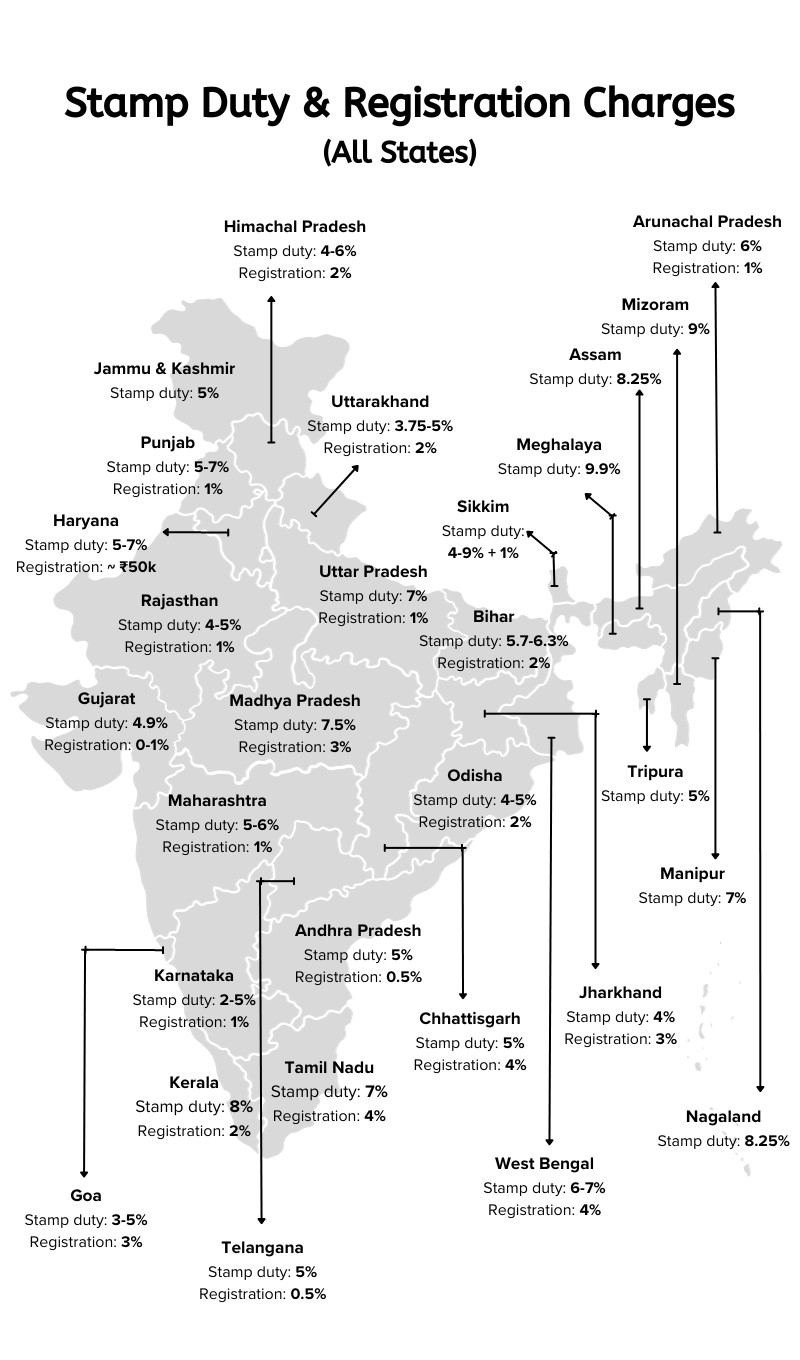

Region

State

Stamp Duty Rates

Registration Fees

Center

5%

4%

7.50%

3%

North

7%

Urban areas (Male buyers)

Up to ₹50,000

5%

Urban areas (Female buyers)

6%

2%

(max amount ₹25,000)

4%

2%

(max amount ₹15,000)

5%

5%

7%

1%

5%

7%

1%

7% - ₹10,000

5%

2%

(max amount ₹25,000)

3.75%

5%

1%

4%

South

5%

0.50%

5%

(property value above ₹45 lacs)

1%

3%

(property value ₹21-45 lacs)

2%

(property value below ₹20 lacs)

8%

2%

10%

0.50%

7%

4%

5%

0.50%

East

5.7%

2%

6.3%

6%

4%

3%

5%

2%

4%

6%

(property value up to ₹1 Cr)

1%

7%

(property value above ₹1 Cr)

West

3.5%

(property value up to ₹50 lacs)

3%

4%

(property value ₹50 - ₹75 lacs)

4.5%

(property value ₹75 lacs - ₹1 Cr)

5%

(property value above ₹1 Cr)

4.90%

1%

NIL for Female Buyers

6%

1%

5%

North East

6%

1%

8.25%

7%

3%

9.90%

9%

8.25%

4% + 1%

9% + 1%

5%

Note: These figures can fluctuate due to policy changes in each state, and it's pivotal to verify the current rates from the respective state government's official website or contact a legal expert to obtain the most accurate and up-to-date information.

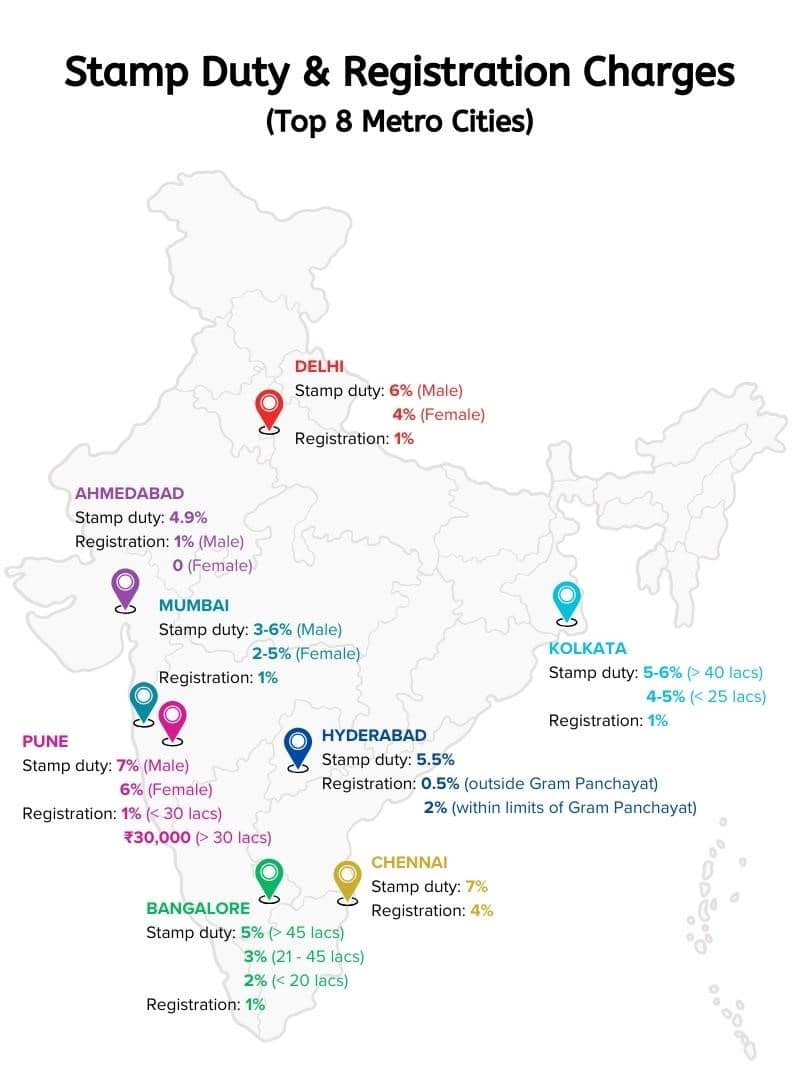

City

Buyer Group

Stamp Duty Rates

Registration Fees

Male

4.9%

(3.5% + 1.4% Surcharge on stamp duty)

1%

Female

No Registation Fee

(male+female)

1%

(female+female)

No Registation Fee

All

5%

(property value above ₹45 lacs)

1%

+ (10% Cess + 2% BBMP Surcharge + 3% BMRDA Surcharge) on stamp duty

3%

(property value ₹21-45 lacs)

2%

(property value below ₹20 lacs)

5.6%

5.65%

All

7%

4%

Male

6%

1%

Female

4%

All

5.50%

0.5%

(in any area except Gram Panchayat)

2%

(in areas falling under Gram Panchayat)

All

5%

(property value above ₹40 lacs)

Kolkata/Howrah & Municipality regions

1%

4%

(property value below ₹25 lacs)

Kolkata/Howrah & Municipality regions

6%

(property value above ₹40 lacs)

5%

(property value below ₹25 lacs)

Male

6%

(5% + 1% Metro Cess in Urban areas)

1%

4%

(within limits of MMRDA)

3%

(within limits of Gram Panchayat)

Female

5%

(4% + 1% Metro Cess in Urban areas)

3%

(within limits of MMRDA)

2%

(within limits of Gram Panchayat)

5%

(within limits of Panchayat or rural areas under MMRDA)

1%

(for properties below ₹30 lacs)

₹30,000

(for properties above ₹30 lacs)

5%

(within limits of cantonment area or municipal corp.)

4%

(within limits of Gram Panchayat)

Male

7%

(5% + 1% Metro Cess + 1% Local Body Tax)

Female

6%

(4% + 1% Metro Cess + 1% Local Body Tax)

(male+female)

6.50%

(female+female)

6%

(male+male)

7%

Note: It is crucial to note that these figures are subject to change due to policy amendments and may vary within different zones of the cities. Always make sure to verify the current rates from the respective city’s official website or consult a legal expert to obtain the most accurate and up-to-date rates.

Stamp duty is calculated on the property value which is the higher value between Agreement Value of the property and Ready Reckoner Rate, in which:

Note: If the Agreement value is lower than the Ready Reckoner Rate (or Circle Rate), then stamp duty charges will be applicable on the Circle Rate. If the Agreement value is higher than the Circle Rate, then stamp duty fees will be applicable on the Agreement value.

For E.g., if the Circle Rate of a property in Bangalore is ₹80 lacs, and the Consideration Amount is ₹60 lacs, then stamp duty rates are applied on ₹80 lacs (which is the higher value of the property).

Stamp Duty = Property Value × Stamp Duty Rate

For E.g., Mr. Anand purchases a 1500 sq. ft. property in Bangalore, where the Circle Rate determined by the local authority is ₹5,000 per sq. ft. The consideration or agreement value of the property is ₹60,00,000.

For calculating stamp duty:

Circle Rate = ₹5,000 per sq. ft.

Size of the Property = 1500 sq. ft.

Consideration Value = ₹60,00,000

(1) Value of the property = Circle Rate x Size of Property = ₹5000 x 1500 = ₹75,00,000

(2) Since the value of the property as per Circle Rate (₹75 lacs) is higher than the agreement value (₹60 lacs), stamp duty charge is calculated on the Circle Rate value.

Stamp Duty Rates applicable in Bangalore for a property valued more than ₹45 lacs is 5%.

(3) Stamp Duty fees = ₹75,00,000 x 5% = ₹3,75,000

Since there are additional charges to be paid for Stamp Duty in Bangalore like Cess of 10% on Stamp duty and Surcharge of 2%, the exact amount of stamp duty to be paid will be:

(3a) Total Stamp Duty Payable = ₹3,75,000 + (10%*3,75,000) + (2%*3,75,000) = ₹4,20,000

As for the registration charges, 1% of the value of the property is charged, so,

Registration fee = ₹75,00,000 x 1% = ₹75,000

Total Stamp Duty and Registration Charges = ₹4,20,000 + ₹75,000 = ₹4,95,000

Therefore, the total amount that Mr. Anand has to pay stamp duty charges and registration costs are ₹4,95,000 on the purchase of property.

Note: that the Stamp Duty is a state subject and its rate and the method of calculation can vary across different states and cities in India. Always refer to the most recent and localized guidelines or consult a legal expert to ensure accurate calculations and compliance.

Try out this Stamp Duty Calculator to get accurate charges.

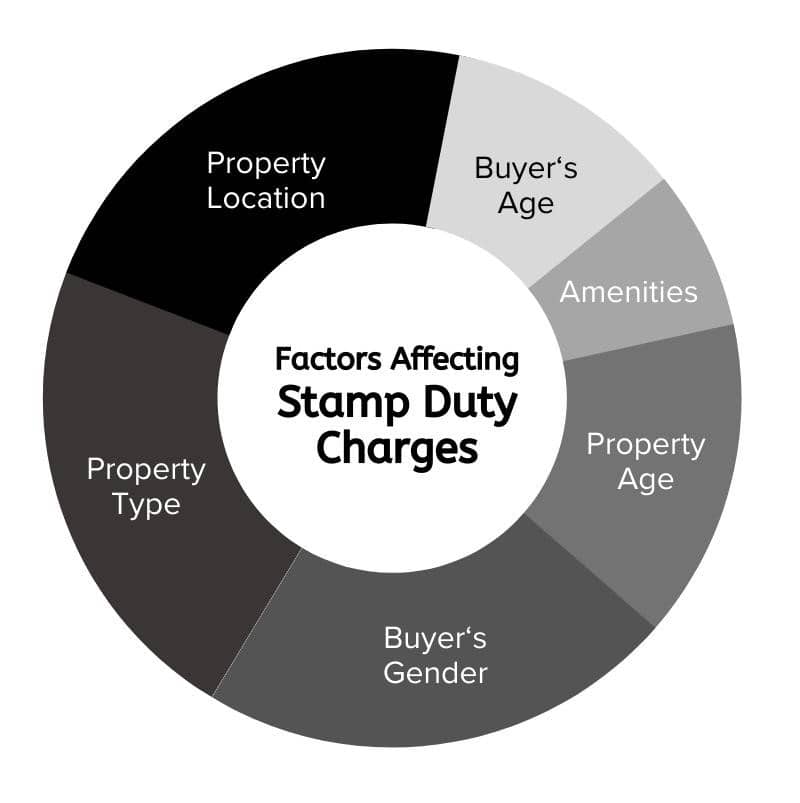

Stamp Duty costs can be influenced by a number of factors. These are some of the key factors that commonly affect stamp duty charges across India.

Stamp duty can vary based on whether the property is being purchased for residential use or commercial purposes. Residential properties often attract lower stamp duties compared to commercial properties.

The location of the property and amenities available in and around the property can affect the stamp duty charges to a great extent. Properties registered in urban areas might have a higher stamp duty compared to those in rural areas.

Age of the property is directly proportional to its market value as old properties tend to cost lesser than new ones. A new property may have higher stamp duties compared to resale properties or those in which the property value is depreciated.

Some states offer concessions on stamp duty for female buyers to promote property ownership among women. In cases of joint ownership, especially where one of the owners is female, different rates might apply.

Almost all state governments offer concessions on stamp duty for senior citizens. Also, first-time buyers may also be offered certain relaxations or benefits.

Properties with additional amenities like a swimming pool, club, gym, etc., might attract higher stamp duty due to increased valuation. The infrastructure around the property, like roads, schools, hospitals, etc., may also influence the property's value and, consequently, the stamp duty amount.

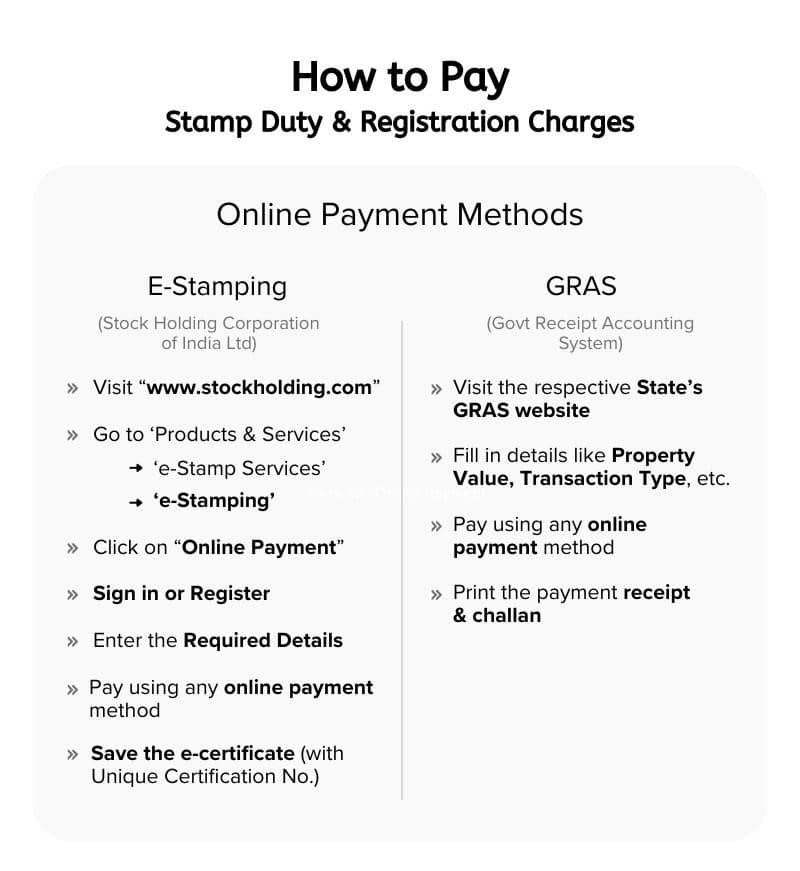

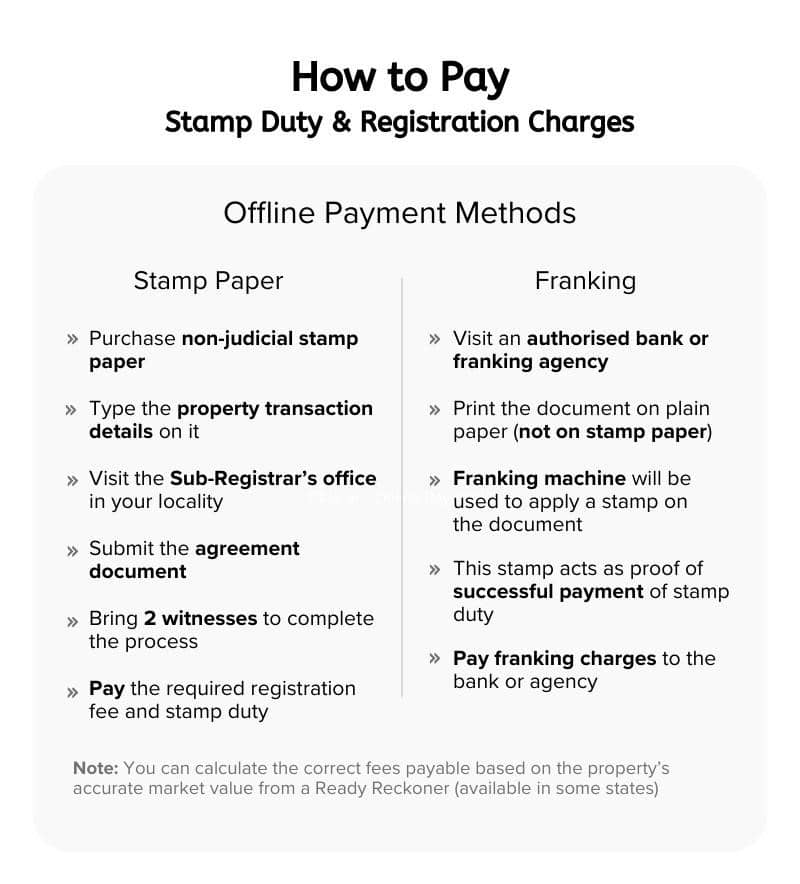

There are various methods available to pay Stamp Duty and Registration Charges, making the process more accessible and convenient for buyers. Each of the following methods have its own set of procedures and applicability, and it’s crucial to choose the one that aligns with your convenience and the norms prevalent in your state.

Franking is the process of stamping legal property documents or attaching a denomination to it.

Always make sure to verify the details and keep the payment receipt safe to facilitate a smooth and transparent property registration process.

The payment of Stamp Duty fees and registration charges of the property involves a set of legal document(s) that need to be accurately prepared, verified, and submitted.

Below is a comprehensive list of documents generally required for the Stamp Duty payment and property registration process:

1. Sale Agreement

2. Sale Deed in the name of seller

3. Property-Related Documents for Verification

4. Proof of Payment of Stamp Duty (E-Stamp Certificate or physical Stamp Papers)

5. Khata Certificate (certificate by the municipal corp)

6. Sale Deed (created on Stamp Paper of value as per the Stamp Duty)

7. No Objection Certificates (NOCs)

8. Property Tax Receipts (last 3 months)

9. Sanctioned Building Plan (purchase of under-construction property)

10. Possession Letter from Builder (purchase of under-construction property)

11 Builder-Buyer Agreement (purchase of under-construction property)

12. Completion Certificate

13. Occupancy Certificate

14. Property Valuation Report

15 A copy of all previous registered agreements (in case of resale of property)

16. Conversion of Land Certificate (in case of land purchase)

17 Records of Rights and Tenancy Corps (RTC) or 7/12 Extract (in case of land purchase)

18 Latest bank statements (in case of outstanding loan amount)

19. Power of Attorney (if applicable)

20. Proof of Identity and Address (any of Aadhar Card, PAN Card, Passport, Voter ID, Driving License)

21. Passport-sized photographs of the buyer and seller

22. ID Proof of at least 2 Witnesses

IMPORTANT NOTE: The exact documents required may vary based on the state, type of property, and specific property transaction details. Always consult a legal expert or real estate advisor to confirm the list of documents required for your specific case.

The payment of Stamp Duty and Registration Charges, which are integral to property transactions and carry a heavy sum of money, come with certain tax deductions that buyers can avail of, thereby easing the financial burden to an extent.

Under Section 80C of the Income Tax Act, 1961, individuals are allowed to claim deductions on the Stamp Duty and Registration Fees paid on the purchase of a property.

From deductions on the principal amount to the interest paid on the home loan, various segments of the Income Tax Act, 1961 provide substantial tax relief to property buyers. Read this Comprehensive Guide on Tax Benefits on Home Loans to get further information on and effectively leverage the various tax deductions available during your property purchase journey.

Navigating through the complexities of Stamp Duty and Registration processes can be daunting, but being aware of the common mistakes and ensuring meticulous adherence to legal norms can help facilitate a smooth and hassle-free property transaction.

Mistake: Often, buyers or sellers might undervalue or overvalue a property, either to save on Stamp Duty or due to a lack of accurate market knowledge.

How to Avoid: Always make sure to get a professional property valuation done by a government-approved valuer. Refer to the circle rates in your state/city and current market trends to ensure that the property is valued accurately to avoid legal repercussions and ensure fair transactions.

Mistake: Overlooking certain documents or not adhering to the prescribed formats and details can lead to delays and legal challenges.

How to Avoid: Maintain a comprehensive checklist of all the required documents and make sure they are accurately filled, signed, and verified by relevant parties. Consult a legal expert or real estate advisor to ensure the documentation is complete and in adherence to legal norms.

Mistake: Skipping thorough verification of the property title, which can later lead to disputes and legal challenges.

How to Avoid: Conduct a detailed verification of the property to verify its legal owner and legitimacy, and making sure it is free from disputes and encumbrances. Get in touch with a legal expert to scrutinize the title documents and provide a legal opinion.

Mistake: Procrastinating o delaying the property registration process after paying Stamp Duty, which might lead to penalties and additional charges.

How to Avoid: Adhere to the stipulated timelines for registering the property after payment of Stamp Duty. Ensure all documents and prerequisites are prepared in advance to avoid any delays. Be aware of the legal timeline within which the registration must be completed to avoid penalties.

Mistake: Overlooking available concessions on Stamp Duty, especially for specific people like women or senior citizens.

How to Avoid: Stay updated with the latest policies and guidelines related to Stamp Duty and Registration Charges. Check if there are any concessions available and understand the criteria to avail them, ensuring to leverage any financial relief provided by the government.

Mistake: Not understanding the implications and legalities of joint ownership and its impact on Stamp Duty and Registration.

How to Avoid: Understand the legal and financial implications of joint ownership. Explore how it impacts Stamp Duty, loan eligibility, and property rights. Ensure that the ownership details are accurately documented and in adherence to the mutual understanding between the parties.

Stamp duty is paid to legalize property transactions, making them admissible as evidence in court. It ensures the legitimate transfer of the property ownership and safeguards the transaction against fraud.

Paying inadequate stamp duty can result in penalties, which can range from 8% to 20% of the shortage amount. Additionally, legal issues might arise, making the property transaction void or disputed.

The process for applying for a stamp duty refund varies across states. Generally, it involves submitting an application to the concerned local authorities, along with the original stamp paper and relevant documents, within a stipulated time frame (often six months from the date of purchase).

Typically, the buyer of the property is liable to pay the stamp duty. However, in some cases, the buyer and seller may mutually agree to share the burden.

Legally, no. Avoiding or evading stamp duty is illegal and can result in penalties and legal consequences.

Some states offer concessions on stamp duty for women, senior citizen, or specific income groups. Exploring and availing these concessions, and ensuring accurate property valuation can help save on stamp duty charges.

Value of the property for stamp duty calculation is generally the higher of the agreement value or the property's market value (as per the circle rate). The stamp duty is then calculated as a percentage of this value, as per the rates prevalent in the respective state.

No, stamp duty is not taxable. However, it can be claimed as a deduction under Section 80C of the Income Tax Act, within the overall limit of INR 1.5 lakhs.

Yes, stamp duty can be claimed as a tax deduction under Section 80C of the Income Tax Act, subject to a maximum limit of INR 1.5 lakhs.

No, stamp duty and Goods and Services Tax (GST) are separate and are paid to different authorities. GST is not applicable on stamp duty costs.

Stamp duty is imposed by the respective state government, and hence, the rates and regulations vary across different states.

Stamp duty evasion might stem from a lack of awareness, the desire to save money, or complexities in the payment process. However, evasion can lead to legal consequences and is not advised.

Typically, banks and financial institutions do not include stamp duty and registration charges in the house loan approved by the bank (it is generally an out of pocket expense). However, some banks might offer loan products that cover these charges.

Not necessarily. While stamp duty value is often based on the circle rate provided by the government, the fair market value is the price that a property might fetch in the open market, which can be higher or lower than the stamp duty value.

Stamp duty can be paid through various modes, including e-stamping, using physical stamp paper, or through the Franking method, depending on the state and the stamp duty amount involved.

Paying stamp duty and registration charges is not merely a financial and legal obligation but a contribution towards structured, secure, and transparent property transactions. It is a step towards safeguarding one’s investment, ensuring the lawful transfer of property, and contributing towards the legal and structural framework that governs property transactions in the nation.

Adhering to legal norms, from accurate payment of stamp duty and registration charges to ensuring meticulous documentation, is not merely a statutory requirement but a pathway to secure and undisputed property ownership. Compliance safeguards your investment, provides legal sanctity to the transaction, and ensures that the property is free from encumbrances and disputes.

Transparent transactions are supported by accurate documentation, rightful payment of the stamp duty costs and registration charges, as well as adherence to legal protocols. It not only safeguards individual investments but also strengthens the integrity and reliability of the property market, ensuring sustainable and equitable growth.

In the world of property transactions, knowledge, compliance, and transparency are your steadfast allies. Here’s to successful, lawful, and joyful property ownership adventures!